5 Documents Every Texas Estate Plan Should Have in 2025

You need five important documents for Estate Planning Texas in 2025. These are a last will and testament, revocable living trust, durable power of attorney, medical power of attorney, and HIPAA authorization. These documents help protect your things and make sure your wishes are followed. They also help keep your loved ones safe. If you keep your estate planning documents updated, you follow the law. You also protect your property from surprise problems. Old papers can cause bad results or even loss of your things. Talk with a Texas estate planning attorney to get advice that fits you.

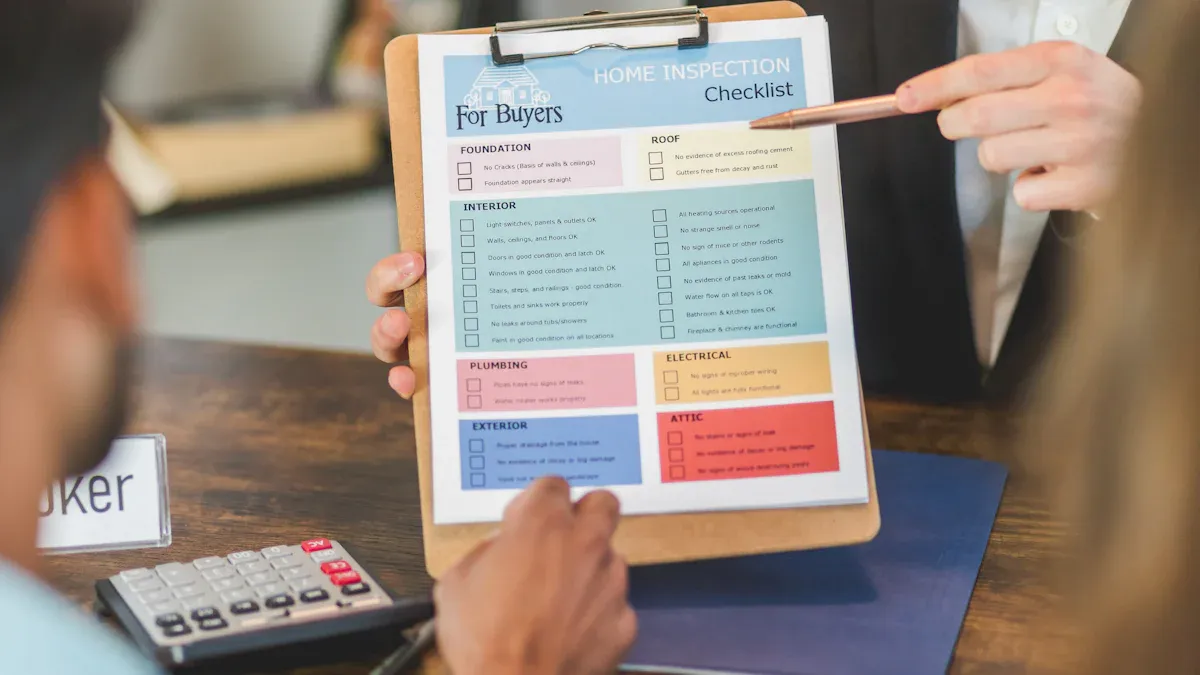

Must-Have Estate Planning Documents

When you start estate planning in Texas, you need to know about five must-have documents. Each one plays a special role in protecting your wishes and your loved ones. Let’s break down what each document does and why you need it in your Texas estate plan.

Last Will and Testament

Your last will and testament lets you decide who gets your property after you pass away. You can name guardians for your children and pick someone to handle your estate. Without a will, Texas law decides who gets your things, and it might not match your wishes. This document gives you control and helps your family avoid confusion.

Revocable Living Trust

A revocable living trust helps you manage your assets while you are alive and after you pass away. You can move your property into the trust and choose someone to manage it if you cannot. This trust lets your family skip probate court, which saves time and keeps things private. You can change or cancel the trust whenever you want.

Durable Power of Attorney

A durable power of attorney lets you pick someone to handle your money and property if you cannot do it yourself. This person, called your agent, can pay bills, manage bank accounts, and take care of your business. You need to choose someone you trust. This document keeps your finances safe if you get sick or hurt.

Medical Power of Attorney

A medical power of attorney lets you choose someone to make health care decisions for you if you cannot speak for yourself. Your agent can talk to doctors and decide on treatments. This document makes sure your wishes are followed, even if you cannot explain them.

HIPAA Authorization

HIPAA authorization lets your chosen people see your medical records. Doctors and hospitals cannot share your health information without this paper. When you have this document, your family and agents can get the details they need to help with your care and make smart choices.

Tip: These must-have estate planning documents work together to protect you and your family. If you miss one, your plan might not work as you want.

You need these must-have documents for estate planning Texas because they cover your property, your health, and your privacy. They help your loved ones avoid court fights and delays. When you have all five, you know your wishes will be respected. Estate planning Texas laws change, so keep your documents up to date. If you want your plan to work, make sure you have these must-have estate planning documents in place.

Last Will and Testament

Purpose and Benefits

A last will and testament is the heart of your texas estate plan. This document lets you say who gets your things after you pass away. You can also name someone to care for your children. If you do not have a will and testament, Texas law decides who gets your property. That might not match what you want.

Here’s why you need a last will and testament in your texas estate planning:

You choose who gets your money, house, or special items.

You pick a guardian for your minor children.

You name someone to handle your estate.

You help your family avoid fights and confusion.

You make the process faster and easier for your loved ones.

Did you know most people do not have a will and testament? Here are some facts:

57% of American adults do not have a will or estate plan. If you do not have one, state law decides who gets your things.

Probate costs in Texas can be $3,000 to $10,000. A will and testament can help lower these costs.

If you die without a will and testament, the court decides who gets your property. This may not match your wishes.

Many people start planning after a big life event, like having a child or facing health problems.

A will and testament can help your family avoid fights and get your property faster.

Tip: A last will and testament gives you peace of mind. You know your wishes will be followed.

Texas Requirements

Texas has rules for making a valid last will and testament. You must:

Be at least 18 years old, married, or in the military.

Write your will and testament while you are of sound mind.

Sign the document in front of two witnesses. These witnesses must also sign.

Make sure your will and testament is in writing. Texas does not accept oral wills.

Keep your will and testament in a safe place. Tell your loved ones where to find it. Review your will and testament after big life changes, like marriage, divorce, or having a child. This keeps your texas estate plan up to date.

Revocable Living Trust

Avoiding Probate

A revocable living trust gives you a way to pass your property to loved ones without going through probate court. Probate can take months or even years. It often costs your family extra money and causes stress. When you use a trust, your assets move directly to the people you choose. You skip the court process. This means your family gets what you leave them much faster.

Probate also makes your will public. Anyone can look up what you owned and who got it. A revocable living trust keeps your wishes private. Only the people you name in the trust know what happens. If you own property in more than one state, a trust helps you avoid probate in each state. That saves even more time and money.

Tip: A trust can be harder to challenge than a will. This helps protect your wishes from family fights.

Asset Management

A revocable living trust helps you manage your money and property while you are alive. You stay in control as long as you want. If you get sick or cannot make decisions, your chosen person (called a successor trustee) steps in. They can pay bills, handle investments, and take care of your property right away. No court needs to get involved.

Here are some ways a trust makes asset management easier:

Your assets transfer smoothly if you become unable to manage them.

Banks and other companies often work faster with trusts than with wills.

You avoid problems like lost wills or mistakes in signing.

If you have property in different states, you do not need to deal with many courts.

A revocable living trust may cost more at first, but it can save your family money and trouble later. For many people, this is a smart choice for estate planning texas, especially if you want privacy and less hassle for your loved ones.

Durable Power of Attorney

Financial Decisions

A durable financial power of attorney gives you peace of mind if you ever get sick or hurt and cannot handle your money. With this document, you pick someone you trust to pay your bills, manage your bank accounts, and take care of your investments. You do not want your family to worry about unpaid taxes or missed payments. The durable financial power of attorney lets your agent step in right away, so your finances stay on track.

Here’s what makes this document so important:

Your agent can talk to banks, pay your mortgage, and handle your business.

You avoid court. Without power of attorney documents, your family might need to ask a judge for help, which takes time and costs money.

Financial companies accept a durable financial power of attorney as legal proof, so your agent can act fast.

You keep things private. Court cases are public, but power of attorney documents stay between you and your agent.

You can make the document broad or limit it to certain tasks. You decide how much power your agent has.

Note: If you do not have a durable financial power of attorney, your family may face expensive court battles and delays. This can lead to missed bills, lost investments, and stress for everyone.

Choosing an Agent

Picking the right person as your agent is a big decision. You want someone who is honest, organized, and good with money. This person will have a lot of responsibility, so trust matters most.

Here are some tips to help you choose:

Pick someone who understands your wishes and will follow your instructions.

Choose a person who is available and willing to help when needed.

Make sure your agent knows how to handle money and can keep good records.

Talk with your agent before you sign any power of attorney documents. Make sure they agree to help.

You can name more than one agent or pick a backup in case your first choice cannot serve.

A durable financial power of attorney can be changed or canceled at any time if you are still able to make decisions. The court can also remove an agent who does not do the job right. This helps protect you from misuse or mistakes.

Tip: Review your power of attorney documents every few years or after big life changes. Keeping them up to date helps you stay protected.

Medical Power of Attorney

Healthcare Choices

A medical power of attorney lets you stay in charge of your healthcare. You choose someone you trust to make medical choices for you. This person is called your agent. Your agent helps if you are too sick or hurt to talk. They can pick treatments, say no to some care, and talk to your doctors. Your agent must do what you want and respect your values.

Dr. Brittany Lamb says a medical power of attorney helps your agent make good choices for you. This makes things less stressful for your family in emergencies. Your agent knows what to do and can act fast. You can feel calm knowing your wishes will be followed.

A medical power of attorney works with your advanced directives and advance healthcare directive. These papers tell your agent and doctors what care you want or do not want. When you have all these documents, your doctors know what to do.

Tip: A medical power of attorney can stop family fights. Your agent has the legal right to decide, so everyone knows who is in charge.

Appointing a Representative

Picking your agent is an important step. You need someone who knows your wishes and will follow them. This person should stay calm and talk well with doctors. Many people pick a family member or a close friend.

Here is how you can pick a medical agent in Texas:

Fill out the right power of attorney forms. You must sign them in front of witnesses.

Talk to your agent about your wishes. Share your advanced directives and advance healthcare directive.

Make sure your agent knows your doctors and where your papers are.

Give copies to your agent, your doctor, and your hospital.

Studies show that when you pick a medical power of attorney, your agent can make all your healthcare choices, even big ones. They must do what is best for you and follow your wishes. If you have advanced directives, your agent must respect them. This helps your care match what you want, even if you cannot speak.

Note: You can change your agent any time if you can still decide. Check your power of attorney papers after big life changes.

HIPAA Authorization

Access to Medical Information

HIPAA Authorization is a legal paper. It lets you pick who can see your private medical records. Without this paper, doctors and hospitals cannot share your health information. They cannot even tell your family. In Texas estate planning, you really need this document. You want your trusted people to get the details if you get sick or cannot talk.

When you sign a HIPAA Authorization, you let your agent or loved ones talk to your doctors. They can ask questions and get test results. They can learn about your health. This helps them make good choices about your care. If you do not have this paper, your family may feel lost in a medical emergency.

Tip: Keep a copy of your HIPAA Authorization with your other estate planning papers. Tell your agent and your doctor where to find it.

Supporting Healthcare Decisions

HIPAA Authorization works with your other estate planning documents. These include your medical power of attorney and advanced directives. When you have all these papers, your wishes are clear. Your agent can act fast. Your agent needs your medical records to follow your advanced directives. This helps them make the right choices for your care.

The HIPAA Authorization form is more than just a paper. It helps your healthcare agent get the facts when you cannot talk. This way, your medical wishes are respected. Your agent can make smart decisions. Many experts say you should have HIPAA Authorization, medical power of attorney, and advanced directives. These give your loved ones what they need to help you.

Note: If you update your advanced directives, check your HIPAA Authorization too. Keeping everything current helps your plan work the way you want.

Keeping Your Estate Planning Documents Updated

When to Review

You should not set your estate plan and forget it. Life changes fast. Big events like marriage, divorce, or having a child can change what you want. You might buy a new house or start a business. These moments mean it is time to look at your estate planning documents again.

Most experts say you should review your estate plan every three to five years. This helps you catch mistakes or changes in the law. If you move to a new state, you need to check your documents right away. Texas laws can be different from other states. Regular reviews keep your wishes clear and your plan strong.

Tip: Write down any big life changes. Bring this list when you meet with your attorney. It helps you remember what needs to be updated.

Risks of Outdated Documents

Old estate planning documents can cause big problems. If you do not update your plan, you might name someone who has passed away as your executor. Courts may have to pick someone else, which takes time and money. Sometimes, people forget to change their beneficiary after a divorce. This can send money to an ex-spouse by mistake.

Here are some common risks when you do not update your estate plan:

You might have an executor or agent who cannot serve.

Old trusts may not follow new tax laws, which can cost your family more.

Outdated beneficiary names can send assets to the wrong person.

Courts may need to step in if your documents are unclear or incomplete.

Family fights can happen if your plan does not match your current wishes.

Mistakes in signing or missing witnesses can make your will invalid.

Ambiguous language or typos can lead to court battles and delays.

You want to avoid these headaches. Keeping your estate planning texas documents current protects your family and your wishes. A quick review every few years can save a lot of trouble later.

Working with a Texas Estate Planning Attorney

Legal Compliance

You want your estate plan to work right. Texas law has strict rules for wills and trusts. If you skip a step, your plan might not work in court. A Texas estate planning attorney can help you. Attorneys know the law and keep your documents correct. Missing witnesses or unclear words can cause big trouble. You do not want your family to deal with court fights or delays.

Aspect | With an Attorney | Without an Attorney |

|---|---|---|

Legal Validity | An expert makes sure you follow Texas law | More mistakes and more arguments |

Complex Situations | Plans for blended families and businesses are custom | You might miss important details and have problems |

Tax & Asset Issues | Get advice to lower taxes and probate costs | Not much help with tricky tax questions |

Overall Peace of Mind | A complete plan for you and your family | You may worry and have problems later |

Many people try to write their own wills. Sometimes, they leave out important things or use the wrong forms. One person wrote a will without help. Later, an attorney found problems that could have caused family fights. The attorney fixed the will and helped the family feel better. Only about one-third of Americans have a will, so mistakes happen a lot. You can avoid these problems by working with a professional.

Tip: An attorney helps you avoid mistakes like missing names or missing signatures.

Personalized Guidance

Every family is different. You might have a blended family, a business, or special wishes. A Texas estate planning attorney listens to what you want. They help you make a plan that fits your life. You get advice about taxes, trusts, and how to keep your loved ones safe. Your attorney can also update your plan if laws or your life change.

Here are some steps to find the right attorney:

Ask friends or family if they know a good attorney.

Look at reviews online and check attorney websites.

Find someone who works on estate planning in Texas.

Meet the attorney to see if you feel comfortable.

Ask about their experience and what they do.

You do not have to do this alone. With the right attorney, your plan will follow Texas law and match your wishes. This means less stress for you and your family.

You have learned about the five important estate planning documents for Texas. These are last will and testament, revocable living trust, durable power of attorney, medical power of attorney, and HIPAA authorization. These documents help keep your wishes safe and protect your loved ones. Make sure your papers are current and follow Texas law.

Want to begin? Collect your documents or set up a meeting with a Texas estate planning attorney now. You will be glad you did! 📝

FAQ

What happens if you do not have a will in Texas?

If you do not have a will, Texas law decides who gets your things. The court picks someone to handle your estate. Your wishes may not get followed. Your family could face delays and stress.

How often should you update your estate plan?

You should review your estate plan every three to five years. Big life changes, like marriage or having a child, mean you need to check your documents sooner. Keeping things current helps your plan work right.

Can you make changes to your estate planning documents?

Yes, you can update most estate planning documents at any time if you can still make decisions. You just need to sign new papers. Always tell your family and your attorney about any changes.

Who should you choose as your power of attorney?

Pick someone you trust. This person should be responsible and good with money or healthcare choices. Many people choose a close family member or friend. You can name a backup agent, too.

Tip: Talk with your chosen agent before you sign. Make sure they agree to help and know your wishes.

See Also

A Complete Guide To Using Texas Estate Planning Tools

How To Effectively Manage Retirement Funds In Texas

Getting Started With The Fundamentals Of Texas Estate Planning

Subscribe to get the updates!

Sign up now to receive timely blog updates.

I accept the email subscription terms.