Must-Know Tips for Texas Families Planning Their Estate

Estate planning Texas is important for all families, not just rich ones. Many Texas families have problems when there is no plan. Did you know 35% of adults have seen family fights because someone did not do estate planning? If you want to keep your things safe and make sure your wishes matter, it is smart to start soon. Estate planning Texas helps your family feel less worried and more calm later.

Start Estate Planning Early

If you start estate planning early, you have more control. You also feel calmer about the future. Life can change fast, so it is smart to plan ahead. Early planning helps protect your family and your things for a long time. In Texas, families who plan early often avoid big problems later. For example, if you set up an irrevocable trust early, it can keep your things safe from creditors. It can also help with Medicaid and make sure your wishes are followed. You might get tax breaks and skip some probate issues. If you plan early, you choose who gets your things, not the state.

Define Your Goals

Before you fill out forms, think about what you want. Ask yourself: Who should care for you if you cannot? What do you want to leave for your kids or loved ones? Do you want to help a charity or a cause?

Tip: Write your goals down. This keeps you on track and helps you talk with your family or a lawyer.

Here are some common goals people have:

Make sure your things go to the right people.

Avoid long and costly court steps.

Lower taxes and fees for your family.

Give clear rules for your care if you get sick or cannot decide for yourself.

Help your children, spouse, or others who depend on you.

Getting the right facts is important. You should gather details about your age, family, money, debts, and investments. Many people use interviews, surveys, or check their bank and insurance papers to see the full picture.

Take Inventory of Assets

Now, make a list of what you own. This step helps you see your things and what needs protection. Start with your house, cars, bank accounts, and retirement plans. Remember jewelry, collectibles, or even digital things like online accounts.

Here’s an easy way to sort your assets:

Asset Type | Examples |

|---|---|

Real Estate | Home, land, rental property |

Financial Accounts | Checking, savings, investments |

Personal Property | Cars, jewelry, art, electronics |

Business Interests | Ownership in a company |

Digital Assets | Online accounts, cryptocurrencies |

Knowing what you own makes estate planning texas easier. It also helps you find anything you forgot, so your plan covers everything that matters to you.

Create an Effective Estate Plan

Building an effective estate plan in Texas means taking clear steps to protect your family and your wishes. You do not need to be wealthy to benefit from this process. Many families find peace of mind by making sure their plans are solid and easy to follow. Let’s break down the most important parts.

Write a Will

A will is the foundation of effective estate planning. It tells everyone what you want to happen with your things after you pass away. You can name who gets your house, money, and special items. You can also say who will take care of minor children if something happens to you. Without a will, Texas law decides for you, and that can lead to family fights or confusion.

Many people think a handwritten will is enough, but Texas courts often reject these if they do not meet strict rules. For example, in one Texas case, a handwritten will was not accepted because it was not signed right and the witnesses were not trusted. This led to a long court battle. Experts say working with an estate planning attorney helps you avoid these problems. A good attorney makes sure your will is clear, legal, and covers everything you care about. This reduces the risk of costly court fights and gives your family clear instructions.

Tip: Always update your will after big life changes, like marriage, divorce, or having a new child.

Set Up Trusts

Trusts are another key part of an effective estate plan. A trust lets you control how and when your assets go to your loved ones. You can use a trust to help with the care of minor children, protect your money from creditors, or make sure a family member with special needs gets support. Trusts can also help you avoid probate, which saves time and money.

Many families use trusts to keep things private and simple. If you want to lower taxes or make sure your wishes are followed, a trust can help. Estate planning attorneys often suggest trusts for families with young kids, blended families, or anyone who wants more control over their assets. The Stevenson Law Office says that smart planning with trusts can help you follow tax laws and avoid big tax bills or legal problems.

Specify Beneficiaries

You need to clearly name who gets your assets. This step is simple but very important. If you do not list your beneficiaries, your assets might not go where you want. You can name beneficiaries for things like life insurance, retirement accounts, and bank accounts. Make sure the names are correct and up to date.

Here are some ways to reduce family fights and confusion:

Talk openly with your family about your wishes.

Work with an estate planning attorney to handle legal details.

Use trusts to control and keep asset transfers private.

Update your will and trusts often, especially after big life events.

Divide things fairly, or explain your reasons if you do not.

Pick a neutral person to manage your estate.

When you specify beneficiaries, you help your family avoid delays, fights, and hurt feelings. Clear instructions mean less stress for everyone.

Choose Key Roles

Picking the right people for important jobs is a big part of effective estate planning. You need to choose an executor for your will, a trustee for your trust, and someone to make decisions if you cannot. These people should be trustworthy, organized, and able to handle tough situations.

Here are some tips for choosing the right people:

Pick someone who is honest and reliable.

Make sure they have time to do the job.

Choose people who can handle paperwork and money.

Think about naming a professional or co-trustee if your estate is complicated.

Talk to your family about these roles before you decide.

Estate planning attorneys and experts say that trustworthiness, skill, and availability matter most. If you have a complex estate, a professional executor or trustee can help avoid problems. Discuss these jobs with your family so everyone knows what to expect.

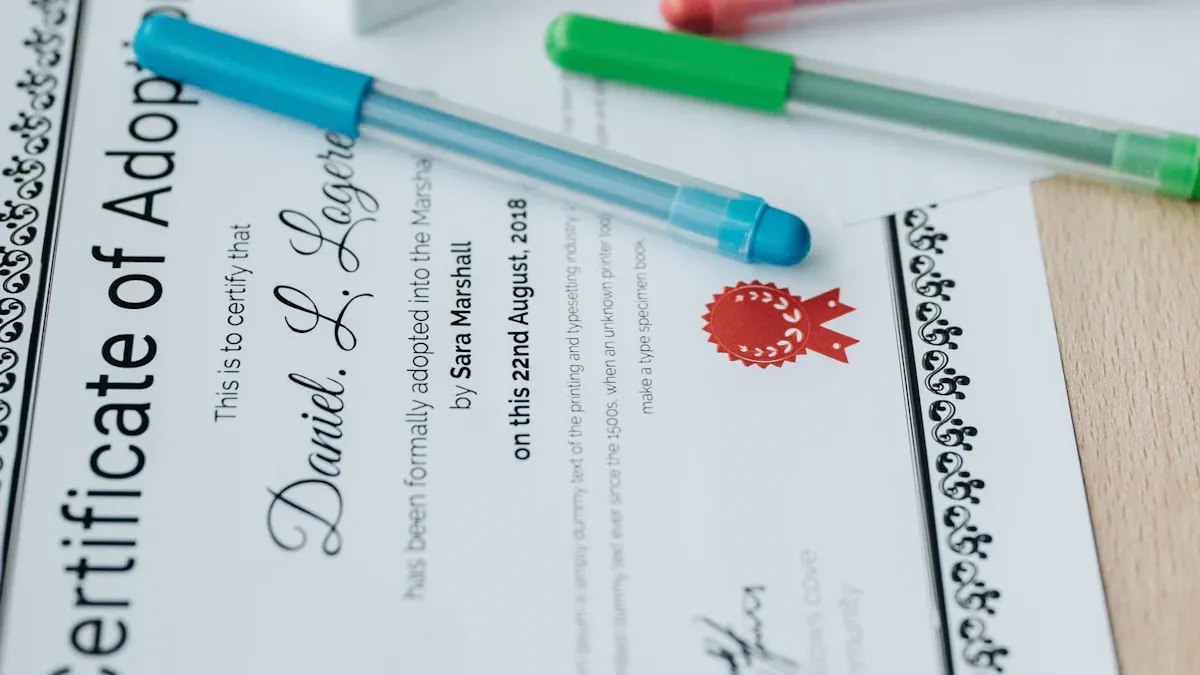

Note: The care of minor children is one of the most important reasons to have a will and trust. You can name a guardian in your will, and use a trust to manage money for your kids until they are old enough.

A structured estate plan gives you and your family legal and financial security. Studies show that people who work with financial planners and attorneys are much more likely to have valid wills and trusts. This means fewer court battles, lower taxes, and more peace of mind for everyone.

Texas Estate Planning Essentials

Community Property Laws

In Texas, community property laws decide how married couples share things. If you are married, most things you buy or earn together belong to both of you. You both own these things the same amount. If you get divorced or need to split things, the court looks at many details to be fair.

Courts try to split things equally, but they look at how long you were married, your health, and your income.

Separate property, like gifts or things you had before marriage, stays yours if you can prove it.

Liquid assets, like cash or money in the bank, are usually split in half.

Retirement and investment accounts from your marriage are divided too, and sometimes need special court papers.

Debts from your marriage are shared by both people.

Experts might help figure out how much your things are worth to keep it fair.

Knowing these rules helps you protect your family. It is a big part of estate planning texas.

Transfer on Death Deeds

A Transfer on Death Deed lets you give your house or land to someone after you die. This skips probate and saves your family time and money. You keep control of your property while you are alive. You can change your mind or sell your house whenever you want. When you die, the person you picked gets the property right away. Many people use a TODD in their texas estate planning to help their family.

Tip: Always file your TODD with the county clerk so it works right.

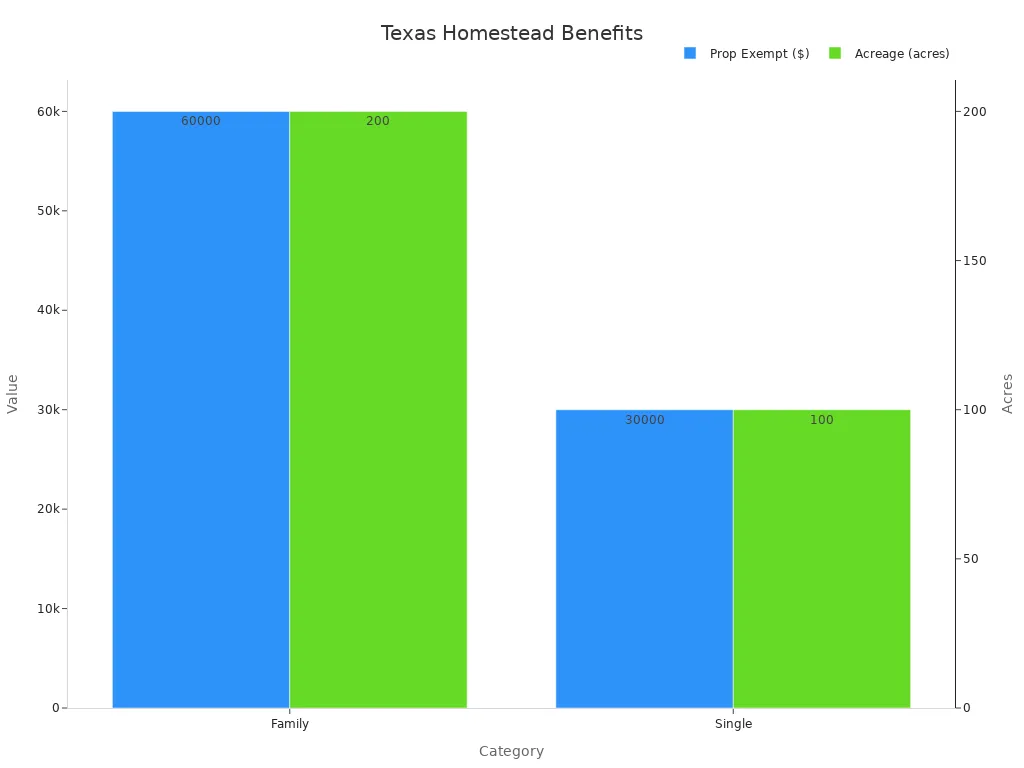

Homestead Protections

Texas has strong homestead protections. These laws protect your main home from most people you owe money to. You do not have to worry about losing your house because of most debts, except for things like your mortgage or taxes. The law also protects some of your things and even your paychecks.

Category | Limit/Value |

|---|---|

Homestead Exempt Value | No dollar limit on the exempt value of the residence itself |

Personal Property Exemption | $60,000 for a family; $30,000 for a single adult (excluding liens) |

Rural Homestead Acreage | Up to 200 acres for a family; up to 100 acres for a single adult |

Wage Garnishment Protection | Current wages exempt except for child support; includes severance pay and unpaid commissions |

Homestead protections help you feel safe. They help you keep your home and important things safe as you plan for the future. Many families use these protections in their estate planning texas plan.

Plan for Incapacity and Long-Term Care

Life can change in a moment. If you ever get sick or cannot make decisions, you want your wishes to be clear. Planning for incapacity and long-term care helps you stay in control and protects your family from stress and money problems.

Powers of Attorney

A power of attorney lets you pick someone you trust to handle your money or health decisions if you cannot. You can choose a family member or a close friend. This person can pay your bills, manage your bank accounts, or talk to doctors for you. If you do not have a power of attorney, your family might need to go to court to help you. That takes time and money.

Tip: Choose someone who knows your values and will act in your best interest.

Advance Directives

Advance directives are written instructions about your health care. They tell doctors and family what you want if you cannot speak for yourself. This can include things like life support or pain care. Many people do not have these papers, but they make a big difference.

Statistic | What It Means |

|---|---|

40% of Medicare patients do not have an advance directive | Many people risk getting care they do not want |

Patients with advance care plans get less unwanted treatment | Your wishes are more likely to be followed |

More likely to use hospice and avoid hospital deaths | You get comfort-focused care |

The Five Wishes program has helped millions share their health care choices. When you write your wishes down, you help your family avoid hard decisions and costly treatments you may not want.

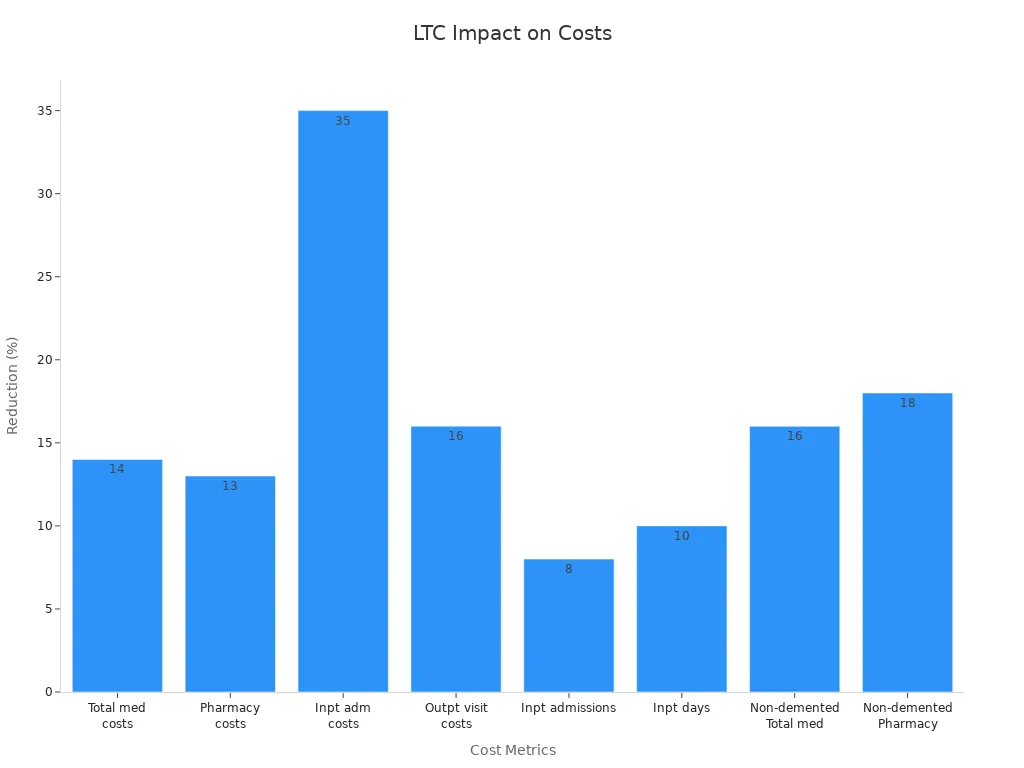

Long-Term Care Planning

Long-term care planning means thinking ahead about help you might need as you get older. This could be home care, assisted living, or nursing care. Planning early gives you more choices and saves money. Research shows that people who plan can cover most care costs by using savings or insurance.

What Planning Can Do | Details |

|---|---|

Cover 2 years of home care | 74% of older adults can do this by using assets |

Cover 2 years of assisted living | Nearly 90% can pay for this with planning |

Best time to start planning | By age 40, finish by age 65, aim for $70,000 saved or insured |

Long-term care insurance can lower your medical costs by up to 14%. It also means fewer hospital stays and lower pharmacy bills.

When you plan for incapacity and long-term care, you protect your savings and give your family peace of mind.

Keep Your Plan Current

Review Regularly

You might think your estate plan is set once you finish it, but things change all the time. Laws about taxes and estates often shift. If you do not review your plan, you could miss out on new tax breaks or face extra costs. Experts say you should look over your estate plan every 3 to 5 years. This helps you stay in line with Texas laws and federal rules. When you review your plan, you make sure your wishes still match your life.

Tip: Set a reminder on your calendar to check your estate plan every few years. This small step can save your family from big headaches later.

If you move to a new state, your old plan might not work the same way. Regular reviews help you keep beneficiary designations up to date, so your money and property go to the right people. You also avoid family fights and make sure your plan follows the latest laws.

Update After Life Events

Big changes in your life mean you need to update your estate plan. Did you get married, have a baby, or buy a house? Maybe you started a new job or lost a loved one. Each of these moments can change what you want for your family and your things.

Here are some times when you should update your plan:

Marriage or divorce

Birth or adoption of a child

Death of a loved one

Big changes in money or property

Moving to a new state

When you update your plan, you protect your assets and keep beneficiary designations up to date. This helps your family avoid confusion and keeps your wishes clear. You can also add new things, like digital accounts, or use new tools to protect your money. Keeping your plan current brings peace of mind and helps your family stay united.

Avoid Common Mistakes

Be Specific in Your Will

You should make your will very clear. If you are not clear, your family might fight. Saying “split everything equally” can confuse people. Your family may not know who gets what. Brothers and sisters might argue about the house or special things. You can stop this by naming who gets each item.

Detailed wills and trusts help everyone know your wishes. This can stop fights between siblings.

Talking with your family helps them understand your plan.

Picking someone not in the family as executor keeps things fair.

Change your will after big life changes to avoid problems.

Mediation can help solve fights fast and keep peace.

When you explain your choices and talk about your plan, you lower the risk of fights and court battles. If you have a blended family or special gifts, write it all down. This helps everyone know what you want and keeps your family together.

Don’t Overlook Digital Assets

You probably have more digital assets than you think. These can be photos, emails, social media, or online bank accounts. You might even have cryptocurrency. If you do not plan for these, your family may lose access. They could also have legal trouble.

Each website or app has its own rules for access.

Many people forget to put digital assets in their estate plan.

Heirs may have trouble getting into accounts because of passwords or privacy laws.

Make a list of your digital assets and update it often.

Use a password manager or digital vault to keep information safe.

Name a digital executor in your plan.

If you include digital assets in your estate plan, you make things easier for your family. You also protect your memories and money from being lost forever.

Watch for Tax Issues

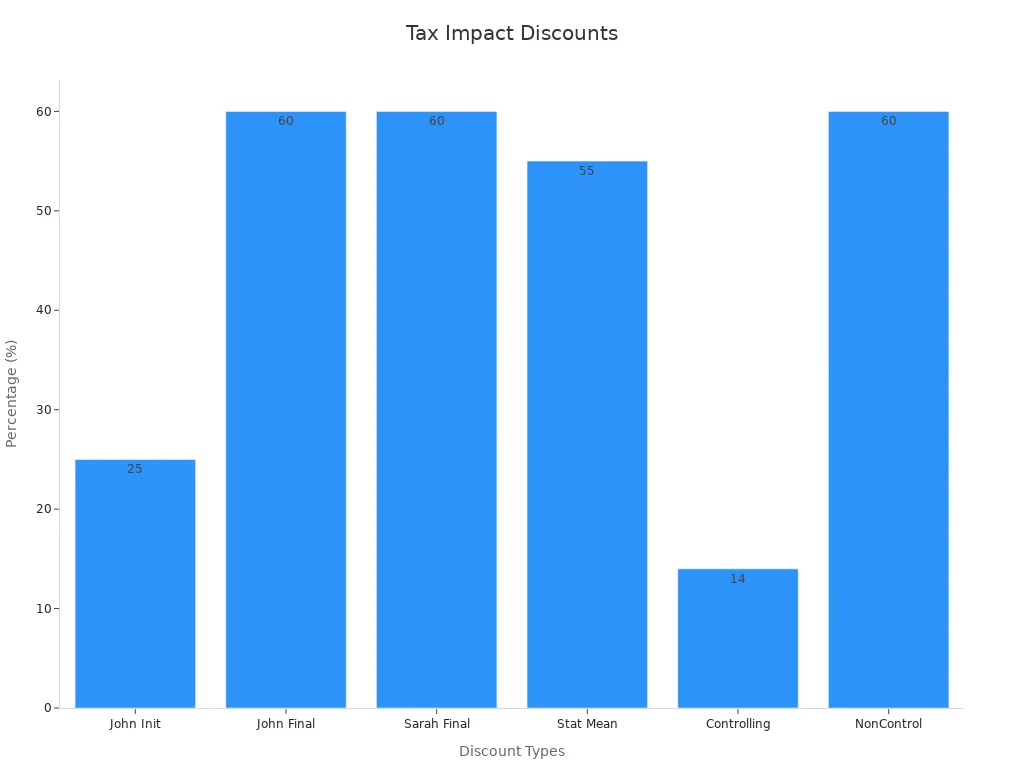

Taxes can take a lot from your estate if you do not plan. In Texas, you still need to think about federal estate taxes. You also need to know how your things are valued. Bad planning or unclear ownership can mean big tax bills.

Aspect | Details |

|---|---|

Poor management | Can cause higher tax discounts and lower estate value |

Family disputes | Make it harder to manage assets and increase tax problems |

Fractional interests | Hard to value, often get big discounts (up to 83%) |

Controlling interest | Lower discounts (about 14%) |

Non-controlling interest | Higher discounts (about 60% or more) |

If you keep your estate organized and talk to a tax expert, you can avoid costly mistakes. Good planning means more of your assets go to your loved ones, not to taxes.

Communicate and Get Help

Talk to Family

It can feel hard to talk about your estate plan. But talking with your family is important. When you share your plans, everyone knows what you want. This helps stop confusion or fights later. You can have a family meeting to talk about your choices. Your loved ones can ask questions or say what they think.

Family meetings let everyone hear your plans and ask things.

Writing down your reasons, like in a letter, helps your family understand your choices.

Being clear means fewer surprises and less chance of arguments.

A good estate plan and honest talks help keep your family together and out of court.

If you make a choice that might shock someone, write down why. For example, if you give more to one child, a letter can explain your reason. This helps your family see your side and keeps things calm.

Consult an Estate Planning Attorney

You do not have to do estate planning by yourself. An estate planning attorney can help you at every step. These experts know Texas laws and help you make a plan for your family. They make sure your papers are correct and legal. This helps you avoid mistakes that cause trouble later.

Estate planning attorneys make plans that fit your family and protect your things.

They help you avoid confusion and make sure your will is legal in Texas.

Attorneys help you update your plan when your life changes.

They prepare important papers like powers of attorney and healthcare forms.

Their skills help you with probate and keep things easy.

Board-certified attorneys have extra training in estate planning and probate.

Online forms may look simple, but they often miss key details. An estate planning attorney makes sure your plan fits your needs. They keep your plan current with new laws. If your estate is tricky, they help with debts, taxes, and what your things are worth. You can feel calm knowing your wishes will be followed. Working with an attorney protects your family from stress and big mistakes.

You can protect what you leave behind by acting now. Start planning early and update your plan often. Talk with your family about your wishes. Many Texas families made living trusts and updated their wills. They also picked clear beneficiaries. This helped them avoid legal problems and gave their families peace.

What Helps Most | Real Benefits for Families |

|---|---|

Living trusts, clear wills, regular updates | Fast asset transfer, less stress, smooth transitions |

Keep taking action. Ask a professional if you need advice. What you do now keeps your family safe in the future.

FAQ

What happens if I die without a will in Texas?

If you die without a will, Texas law decides who gets your things. The court picks someone to handle your estate. Your family may face delays and extra costs.

Do I need a lawyer to make a will in Texas?

You do not have to use a lawyer, but it helps. A lawyer makes sure your will follows Texas law. This can prevent mistakes and family fights later.

How often should I update my estate plan?

You should review your plan every 3 to 5 years. Update it after big life changes like marriage, divorce, or having a child. This keeps your wishes clear.

Can I include digital assets in my estate plan?

Yes! You can list online accounts, photos, and even cryptocurrency. Make a list and share it with someone you trust. This helps your family access your digital life.

See Also

How To Effectively Use Estate Planning Tools In Texas

Complete Guide To Safeguarding Minor Children In Texas Estates

A Detailed Overview Of Trusts And Estate Planning In Texas

Subscribe to get the updates!

Sign up now to receive timely blog updates.

I accept the email subscription terms.