Why Hiring an Estate Planning Attorney Is Crucial in 2025

The laws in 2025 are more complicated than before. Estate planning can feel overwhelming for most people. Without expert help, your plan might be wrong or incomplete. This could put your money and property at risk. Only 32% of Americans have a will. About 60% of those without one haven’t started making one. An estate planning lawyer makes sure your wishes are followed. They also help keep your family safe and protected. Their knowledge helps you understand tricky laws and avoid big mistakes. This gives you peace of mind for the future.

Understanding Estate Planning

What Is Estate Planning?

Estate planning means deciding how to handle your money and belongings if you can’t or after you pass away. It makes sure your wishes are followed, like who gets your things, paying off debts, and caring for kids or pets. It’s more than just writing a will. It also includes trusts, health care plans, and ways to lower taxes and court costs.

As Investopedia explains, estate planning isn’t just for rich people. It’s important for anyone who wants to protect their family and future. The American Bar Association says revocable trusts are helpful. They let you stay in control of your money while making it easier to pass on.

Why Estate Planning Is Essential in 2025

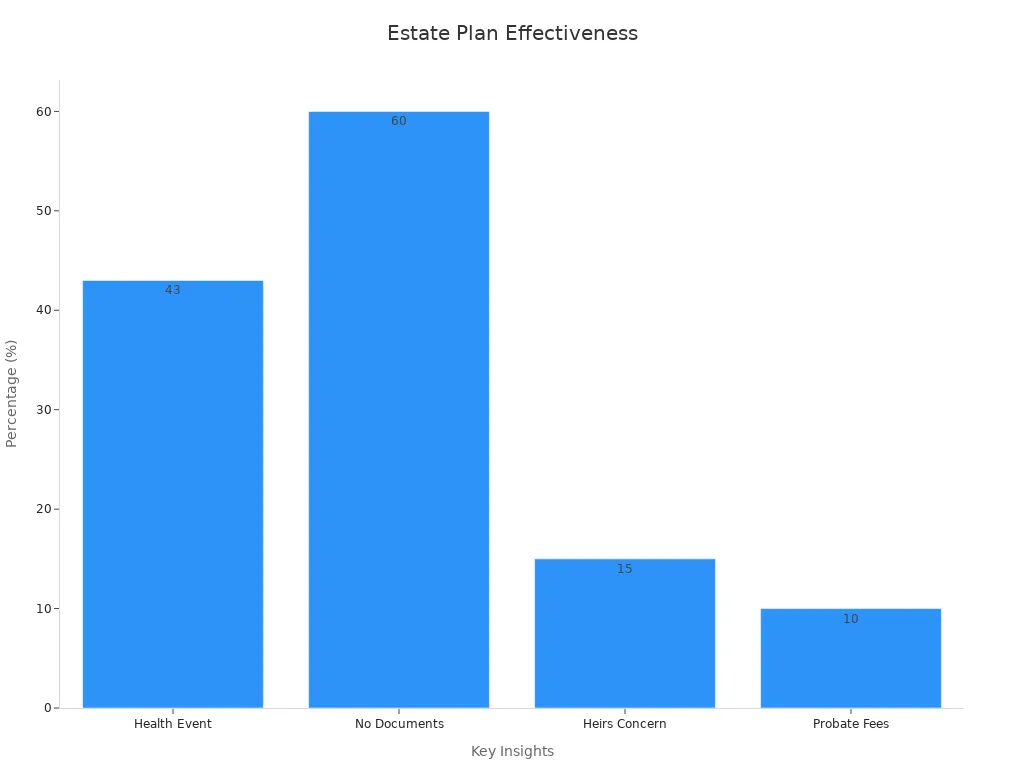

Estate planning is even more important in 2025 because of changing values and money worries. Health problems and big life changes push 43% of people to make a will. Still, 60% of Americans don’t have any estate plan. Without one, your money could lose up to 10% in court fees, leaving less for your family.

Different age groups think about estate planning differently. Younger people, especially those 18-34, often avoid talking about it. But it’s key to keeping their future safe. Worries about money and new priorities have made estate planning about more than just inheritance. It’s now about leaving a legacy and staying secure.

Common Misconceptions About Estate Planning

Some think estate planning is only for rich people, but that’s wrong. Studies show 77% of Americans know it’s important for everyone, no matter how much money they have. Estate planning helps avoid family fights and makes sure your wishes are followed. Without it, 35% of families face arguments.

Another myth is that estate lawyers only write papers. They actually give advice on taxes, protecting money, and health care plans. Some think estate planning costs too much, but it saves money in the long run by avoiding mistakes.

Lastly, many believe a will is enough. A full estate plan also includes trusts, legal powers, and health care plans. This way, all your money and personal wishes are covered.

Benefits of Hiring an Estate Planning Attorney

Legal Expertise and Compliance

Estate planning laws can be confusing and hard to understand. An estate planning attorney makes sure your documents follow the law. They stay updated on new rules, so nothing gets invalidated. Attorneys help you avoid mistakes like old documents or unclear wording. These errors can cause family arguments.

You get advice that fits your personal needs. For example:

Trusts manage your money now and later.

Healthcare directives explain your medical care choices.

An attorney does more than fill out forms. They guide you to make smart choices, ensuring your plans are followed and your family is safe.

Tax Efficiency and Asset Protection

Estate planning isn’t just about splitting up your things. It’s also about keeping them safe. Lawyers help protect your money from losses. Trusts shield your assets from creditors and lawsuits. Gifting and donations can lower taxes.

Strategy | How It Helps |

|---|---|

Gifting | Cuts taxes, saving lots of money |

Trusts | Keeps assets safe from creditors |

Charitable donations | Lowers costs for your family |

Avoiding probate costs | Transfers assets directly to loved ones |

Good planning reduces money problems for your family. With a lawyer, your assets are protected and ready for future generations.

Avoiding Family Disputes and Probate Delays

Without a clear plan, families might argue and face delays. A skilled attorney ensures your documents are clear and legal. This lowers the chance of fights. Knowing a professional handled your estate gives peace of mind.

Probate delays waste time and money. Lawyers speed up the process, so your assets are shared quickly. They understand family issues and help avoid problems. This keeps things calm during tough times.

Hiring an estate planning attorney gives you more than legal help. You get peace, safety, and the promise that your family will be cared for as you wish.

Peace of Mind Through Professional Guidance

Hiring an estate planning lawyer gives more than just papers. It brings peace of mind. A lawyer makes sure your plan fits your needs. This keeps your wishes clear and legally correct. It also lowers the chance of fights or confusion later. You won’t need to worry if your plan will work. Instead, you’ll feel sure it’s strong and ready for life’s changes.

A lawyer does more than fill out forms. They give advice based on your goals. If you want to protect kids, save money, or lower taxes, they help with all of it. Their careful planning keeps your family safe and reduces stress. Knowing your plans are set lets you enjoy time with loved ones.

Working with a lawyer also ensures your documents follow the law. They make sure your wills, trusts, and plans match your wishes. Hiring a lawyer isn’t just about rules. It’s about knowing your family will be cared for as you want.

By hiring a lawyer, you secure your family’s future. Their help makes estate planning easy and gives you peace of mind.

Risks of DIY Estate Planning

Common Mistakes in DIY Estate Planning

Doing estate planning yourself can lead to big mistakes. Many people forget important parts like trusts or health care plans. Some don’t update their plans after big life changes, like marriage or having kids.

Here are common errors people make:

Forgetting to check who gets their money or belongings.

Ignoring online accounts or digital money like cryptocurrencies.

Not thinking about court costs and how they affect your family.

Skipping expert advice, which can lead to serious problems.

Over half of Americans over 55 think it’s wrong not to plan for the end of life. Still, many try to do it alone and make costly mistakes. A bad estate plan can leave your family without the money they need.

Limitations of Online Tools and Templates

Online tools for estate planning might seem easy, but they often fail. These tools don’t handle tricky situations well and lack expert advice.

Problem | Why It’s an Issue |

|---|---|

Doesn’t Follow State Laws | Online tools might not meet your state’s rules, making plans invalid. |

Misses Important Details | DIY tools often skip key parts, leaving gaps in your plan. |

No Help for Complicated Cases | Special family issues need expert advice, not basic online templates. |

Costly Errors | Mistakes in DIY plans can cause big money problems later. |

Online tools might also fail to keep your personal data safe. Without expert help, your plan might not protect your money or follow your wishes.

Real-Life Consequences of Poorly Executed Plans

Bad estate plans can cause serious problems for families. Here are real examples:

John’s old Power of Attorney wasn’t accepted by banks, costing his family time and money.

His will left out his youngest child, and the court ruled against her.

His ex-wife and current wife fought in court, wasting thousands of dollars.

His plan didn’t protect against taxes, so his heirs lost a lot of money.

Medicaid took his home to pay for nursing care, forcing his family to sell it.

These stories show why professional estate planning is important. Avoiding DIY methods helps protect your family from stress, delays, and money problems.

How to Pick the Best Estate Planning Attorney

Important Traits of a Good Estate Planning Lawyer

Finding the right estate lawyer takes careful thought. A good lawyer should explain tough legal ideas in easy words. They need to be detail-oriented to make sure your papers are correct. Kindness and understanding are also important since estate planning involves personal family matters.

Choose a lawyer who focuses on estate planning and stays updated on new laws. They should have experience with cases like yours. Honesty and a promise to protect your interests are must-haves.

Questions to Ask Before You Decide

Asking smart questions helps you pick the right lawyer. Here are some to ask:

Do you mainly work on estate planning?

How long have you been doing this job?

Can you help with wills, trusts, and life insurance?

What are your fees, and what do they cover?

Do you review estate plans regularly?

How do you handle taxes and protect my money?

Can I talk to past clients for feedback?

These questions help you learn about the lawyer’s skills and if they fit your needs.

Warning Signs to Avoid

Not all lawyers are the same. Watch for these warning signs when choosing one:

Warning Sign | What It Means |

|---|---|

Not Licensed | Only licensed lawyers can give legal advice. Avoid anyone without a license. |

Generic Plans | Basic plans don’t meet your specific needs or follow state rules, risking your assets. |

No Real Experience | Lawyers without probate or trust experience might miss important details. |

Avoiding these problems helps you find a skilled lawyer who will protect your family’s future.

Taking Action on Your Estate Planning Journey

When to Start Estate Planning

The best time to plan your estate is now. Experts say to start once you’re an adult. Life is full of surprises, and a plan keeps your wishes safe. Big life events, like marriage or having kids, are great times to plan. For example, 43% of people write a will after a health scare.

If you’re in your 30s, it’s a smart time to begin. By your 40s, it becomes very important. Studies show most people start estate planning at age 42. Waiting too long can leave your family unprepared for emergencies. It’s also important to review your plan often. Updating it makes sure it matches your current needs and goals.

Starting early protects your loved ones and builds your legacy. Whether it’s for your kids or your money, acting now is always the best choice.

Preparing for Your First Meeting with an Attorney

Meeting an estate planning lawyer is an important first step. Being ready helps you get the most out of it. Gather key papers like property deeds, bank statements, and a list of what you own. Think about your goals—who gets your things, your healthcare wishes, and any special plans.

During the meeting, ask questions to learn about the lawyer’s skills. Ask about their experience with wills, trusts, and taxes. Talk about their fees and how they make plans fit your needs. Also, ask how often they update plans and if they help with saving on taxes.

Being prepared saves time and makes you feel confident. A good first meeting helps create a strong plan to protect your family and follow your wishes.

Long-Term Benefits of Professional Estate Planning

Hiring an estate lawyer has many long-term benefits. A good plan makes sure your money and belongings go where you want. It avoids costly mistakes and family fights. It also secures your kids’ future by protecting their finances.

A complete plan lowers taxes and legal costs, saving more money for your family. It also keeps your money safe from creditors and lawsuits, so it lasts for future generations. Regular updates keep your plan useful as life changes.

Most importantly, professional planning gives you peace of mind. Knowing your family is safe and your wishes are clear lets you focus on what matters—spending time with loved ones. Starting today means a safer, happier future for everyone you care about.

Planning your estate is a key way to protect your money and family. Without a good plan, your belongings could face risks. Probate costs might take up to 10% of what you own. An estate planning attorney helps make sure your wishes are followed. They protect your assets and reduce stress for your family.

Did you know?

Health issues or big life changes push 43% of people to make a will.

Still, 60% of people don’t have any estate planning papers, leaving their belongings at risk.

With expert help, you avoid mistakes from doing it yourself. You’ll feel better knowing your plan is strong and legal. A lawyer helps you build a lasting legacy and keeps your family safe. Start planning now—your family will be grateful.

FAQ

What happens if I don’t have an estate plan?

If you don’t have an estate plan, the court decides what happens to your belongings. This process can take a long time, cost a lot, and upset your family. You won’t get to choose who gets your things or who makes healthcare decisions for you.

How much does hiring an estate planning attorney cost?

The price depends on where you live and what you need. Most lawyers charge a set fee or by the hour. It might seem pricey, but hiring a lawyer saves money by avoiding mistakes and keeping your belongings safe.

Can I update my estate plan later?

Yes, you can change your estate plan anytime. Big life events like getting married, having kids, or buying a house mean you should update it. Meeting with your lawyer often helps keep your plan up-to-date and matches your wishes.

Is estate planning only for wealthy people?

No, estate planning is for everyone. It keeps your belongings safe, follows your wishes, and makes things easier for your family. Whether you own a house, have savings, or care for others, an estate plan is important.

How do I choose the right estate planning attorney?

Find a lawyer who knows a lot about estate planning. Ask about their experience, fees, and how they make plans just for you. Stay away from lawyers who offer one-size-fits-all plans. A good lawyer listens and gives advice that fits your needs.

Tip: Start planning now to protect your family and avoid problems later.

See Also

A Complete Guide to Effective Estate Planning for Your Future

The Importance of Ancillary Estate Planning Documents in Texas

Advantages of Powers of Attorney in Texas Estate Planning

Your Definitive Guide to Estate Planning for Future Security

Key Participants in Your Texas Estate Planning Process Explained

Subscribe to get the updates!

Sign up now to receive timely blog updates.

I accept the email subscription terms.